Inflation may have retreated from the double-digit heights of 2022, but at 3.4% on the CPI measure for May 2025 it still erodes the real value of every pound you hold. Put another way, if prices keep rising at the current pace, an item that costs £1,000 today will set you back about £1,034 this time next year. That silent loss affects personal savings, business reserves and long-term plans alike.

As your accountants, our job is to help you keep more of what you earn and to deploy cash and investments where they work hardest. The good news is that the UK tax code still provides several shelters – ISAs, pensions and targeted allowances – capable of outpacing inflation when used thoughtfully. Add a disciplined approach to cash management and a measured mix of inflation-linked or real-asset investments, and you can preserve, and even grow, purchasing power despite the current backdrop.

This guide sets out practical, tax-year-specific steps so you can act with confidence.

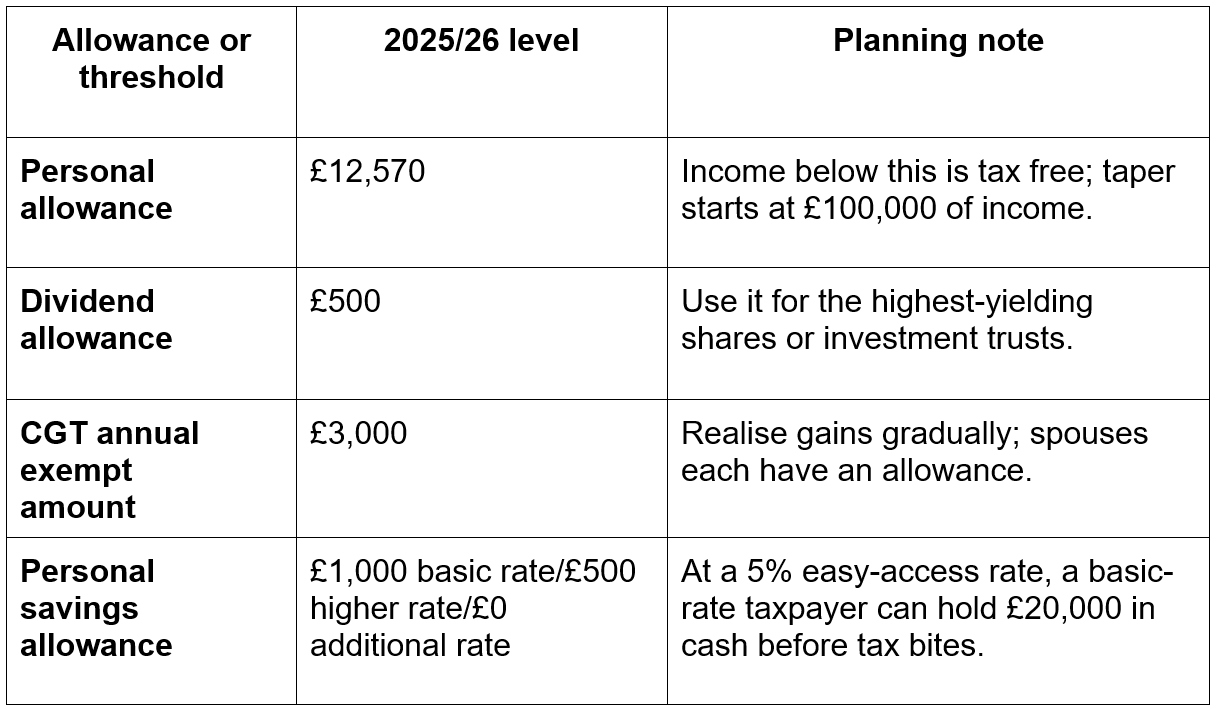

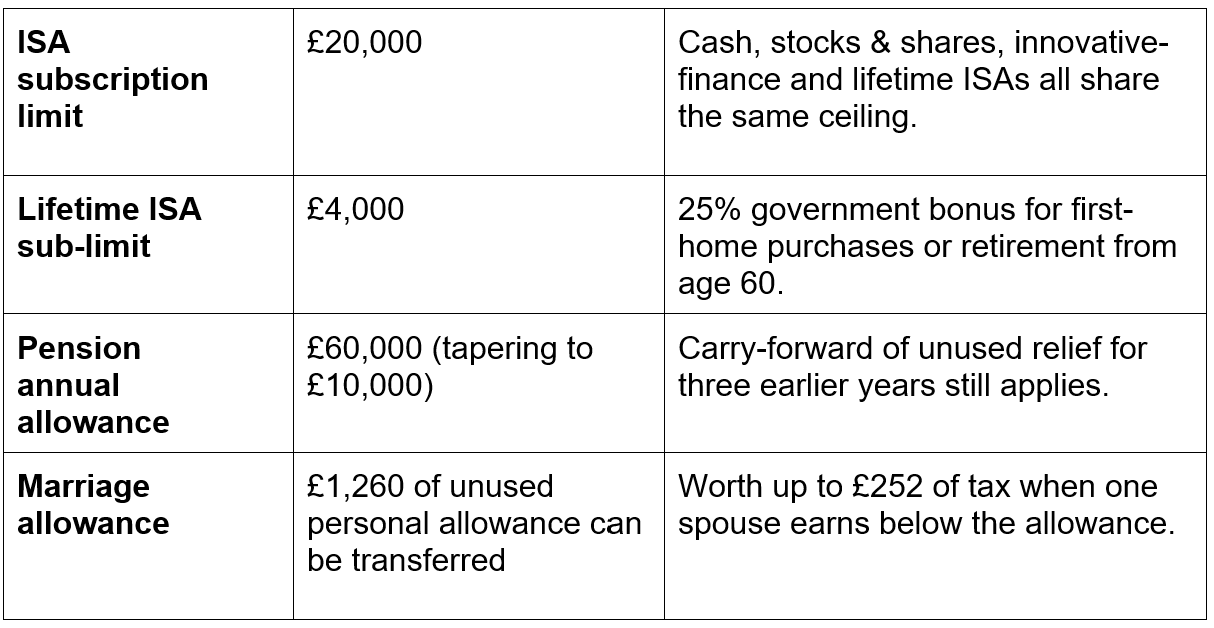

Know the numbers that affect you

Inflation reduces spending power, but tax reliefs can offset a large part of the damage when you use them fully. The table below lists the allowances most readers rely on. We have added two that seldom appear in headline summaries – the personal savings allowance and the marriage allowance – because both can make a material difference to net returns at current interest-rate levels.

How the allowances interact

A higher-rate taxpayer with spare cash might:

1. use their own ISA for equity trackers (capital growth sheltered). To help an adult child with their first-home deposit, gift cash into a Lifetime ISA opened in the child’s own name – only the account holder can use the 25% bonus at purchase.

2. fund a pension up to the £60,000 limit, gaining 40% relief today and tax-free growth thereafter

3. keep the family’s rainy-day cash efficient. Place deposits in the lower-earning (basic-rate) spouse’s name first to use their £1,000 Personal Savings Allowance. After that, hold up to £500-worth of annual interest in the higher-rate taxpayer’s own name to use their £500 allowance. Any surplus beyond those limits can then move into ISAs or joint accounts to avoid taxable interest altogether. (Note: additional-rate taxpayers have no Personal Savings Allowance, so all interest in their name is taxable).

4. realise £3,000 of gains each year to bed-and-ISA shares, resetting the capital gains tax (CGT) base cost without paying tax.

Taken together, those moves put £84,260 under shelter before a single pound of normal taxable investing begins.

Make every tax wrapper work harder

ISAs – front-load where possible

Funding the ISA in April rather than March adds 11 months of tax-free growth. At a 4.5% return that timing difference alone is worth about £825 over five years on the maximum £20,000 allowance. Stocks & shares ISAs remain the long-term growth engine, but cash ISAs still suit the following.

● Short-term targets: A wedding deposit or school fees due inside three years.

● Risk-averse clients: Who would otherwise breach the savings allowance and face tax on interest.

Beware a policy change: media reports suggest ministers are considering capping the cash component of the ISA to £4,000, although no draft legislation yet exists. Monitoring the Autumn Statement will be essential.

Pensions – relief now, inflation-proof income later

Every employee can ask their employer to pay a personal contribution via salary sacrifice. Doing so saves both employee and (usually) employer national insurance (NI); many firms share part of their NI saving, boosting the total invested.

Carry-forward offers a second lever. If you paid only £25,000 into your pension in each of the last three tax years, you have £85,000 of unused relief; add the current £60,000 allowance and, assuming sufficient earnings and no tapering, you could invest up to £145,000 in 2025/26 without breaching the annual allowance rules. That lump sum shelters far more from inflation-driven tax drag than drip-feeding alone.

Lifetime allowance replacement

Since April 2024 the lifetime allowance has been abolished and replaced by two lump-sum limits. That reform removes the fear of an unexpected 55% charge for many savers, so clients who froze contributions earlier can reconsider. We recommend a review for anyone whose fund sat near £1m in 2023/24.

Keep cash competitive

High-street current accounts still pay close to zero, but competition among challenger banks has raised top easy-access rates to 5% AER (Chase saver with boosted rate). Several other providers pay 4.4-4.8%. If you prefer the security of Treasury backing, NS&I’s products remain solid, though the Premium Bond prize-fund rate will trim to 3.60% from August 2025.

A simple three-bucket model works.

1. Immediate access (1-3 months of spending) – keep this in the highest-paying easy-access or current account.

2. Known outgoings (3-12 months) – ladder one-year fixed bonds. The best Moneyfacts-listed bonds pay 4.5-4.6% today.

3. Reserve (1-5 years) – use British Savings Bonds (three-year term now 3.84% AER) or a gilt-backed money-market fund yielding around 4.4%.

Tip for business owners: Corporate treasury portals such as Flagstone and Insignis let limited companies spread deposits across many banks while keeping within the £85,000 FSCS cap.

Add inflation-linked assets

Index-linked gilts

The Debt Management Office issues gilts indexed to the Consumer Prices Index (CPI). Both coupon and principal adjust, so although the running yield is low (-0.3% real on a 2037 linker at the time of writing), the bonds guarantee purchasing-power preservation if held to maturity.

Investors often prefer funds or exchange-traded funds (ETFs) because they:

● remove single-bond risk

● simplify reinvestment of accrued indexation

● qualify for bond-fund exemptions on capital distributions, reducing paperwork outside wrappers.

Remember, indexation lag means gilt cashflows reflect CPI eight months earlier, not the month of payment.

Inflation-linked corporate bonds

National Grid, Network Rail and major utilities have issued bonds linked to the retail prices index (RPI). When held through an inflation-linked corporate bond fund they can improve yield by 0.5-0.8 percentage points versus gilts, but credit risk rises, so keep exposure modest (perhaps 10% of a fixed-income sleeve).

NS&I index-linked savings certificates

These are still the “holy grail” for long-term cash savers thanks to tax-free, RPI-linked returns. No new issues have appeared since 2011, but do not cash in old tranches unless an urgent need arises – any comparable product today sits well below them.

Equities: The long-run inflation hedge

Stocks have beaten UK inflation in 17 of the last 20 rolling 10-year periods. A widely used global all-cap tracker delivered an annualised 6% dividend growth over the past decade, according to MSCI data.

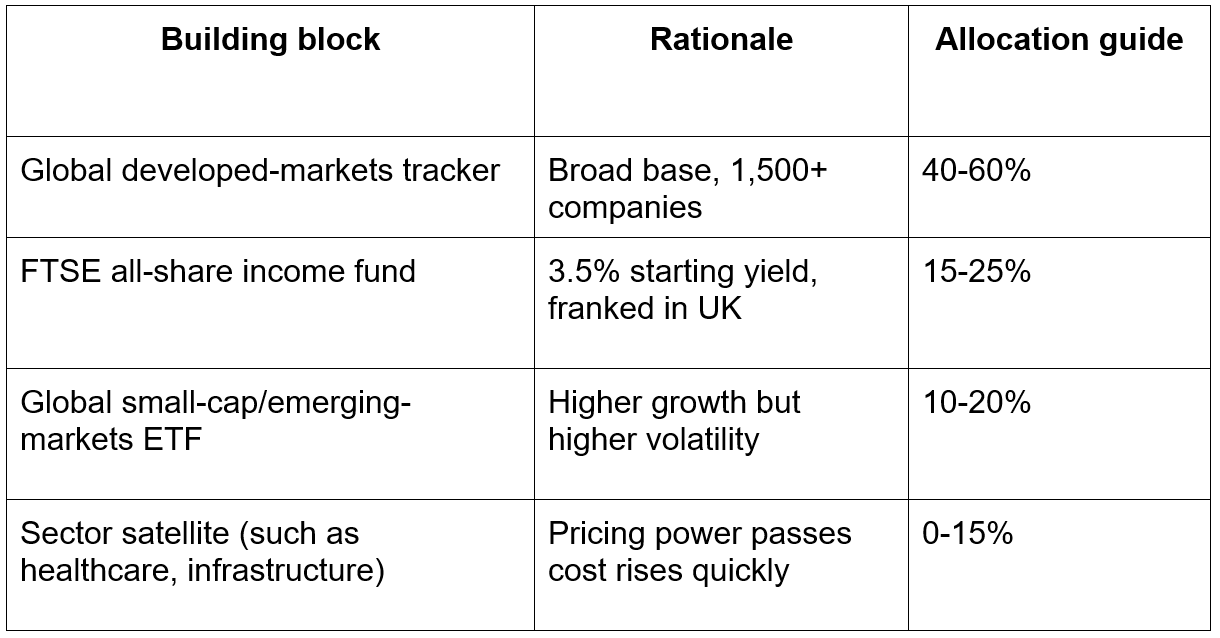

Constructing a resilient share portfolio

Investors who dislike day-to-day volatility can split the equity sleeve between accumulation (reinvested dividends) and income share classes. Reinvested income historically accounts for more than half the FTSE 100’s total return.

Set Yourself up for Success

Did you know that we run the highest rated accountancy firm in Blackburn with Darwen?

Book your 30 minute discovery call today— enjoy a relaxed, no-obligation chat with one of our qualified accounting advisors. We can assess your situation and determine how to best serve and add value to your business.

Alternatively, you can send us a message with any queries (big or small), and one of our team members will get back to you promptly.